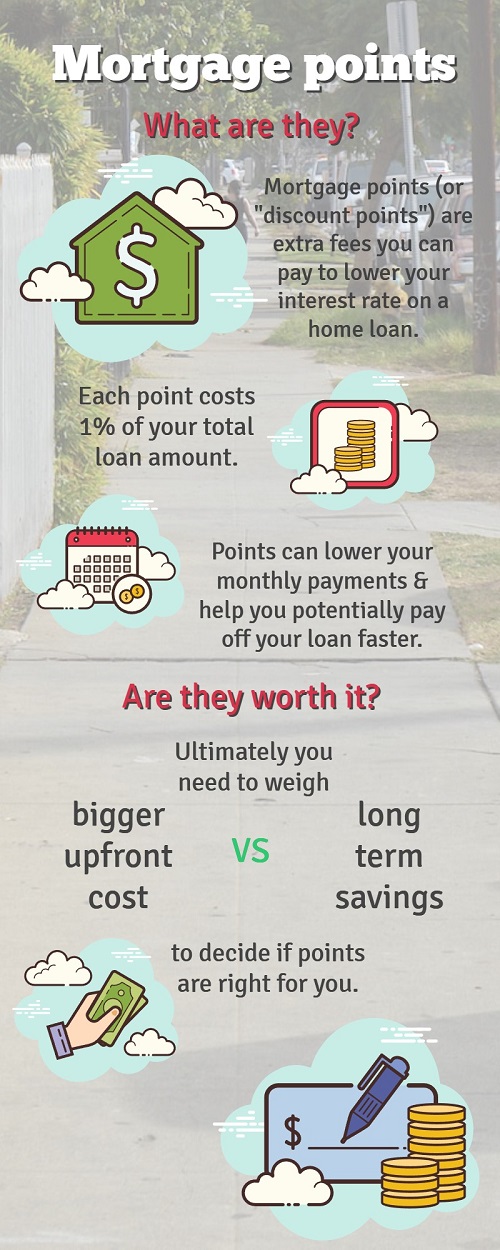

When considering the myriad choices for home financing, homebuyers might wonder, “Are mortgage points worth it?” By paying special fees to the lender, you can sometimes get a lower interest rate. However, the points are no small expense. It’s important to weigh the pros and cons before deciding.

Mortgage points, also called discount points, are fees paid by borrowers to reduce loan interest rates. Terms and conditions of different points vary from one lender to the next, but the pricing is typically standard across lenders. Each individual point costs 1% of your loan amount.

Mortgage points have the potential to significantly lower your monthly mortgage payments and help you save money in the long term. As interest rates rise, using points can be a worthwhile strategy for making your mortgage more affordable.

Lower monthly payments and a lower interest rate are excellent advantages of mortgage discount points, but what are the downsides? One major disadvantage is, to truly save money, you must stay in the home for a long enough time to reach a “break even point,” or the amount of time it will take for your savings to be greater than the amount you pay out.

If you have plans to refinance or sell your home in the near future, you may lose money on discount points by not taking full advantage of the prepaid interest.

Buying points from your mortgage lender might be worth it in some cases, but every financial situation is different. If you plan to stay in your home for the entirety of the loan term, you’ll eventually benefit from the upfront cost of points and save a large amount of money.

However, homebuying already comes with significant upfront costs, and you may not want to add another to the list. Instead, some financial experts suggest putting extra money toward a larger down payment instead, as this can also affect your interest rate in some cases.

Are mortgage points right for you? Ultimately, only you can decide. Keep these factors in mind when considering your options for home financing.

Meet Kimberly Jokela:

With a genuine passion in people Kimberly loves helping her clients make their real estate dreams or needs come to life! Specializing in Luxury, Vacation, Retirement or Investment properties.

Born and raised in the midwest in a family with a strong work ethic, filled with creativity & dedication.

Her determination lead her to attend college at the "Philadelphia Performing Arts" where she had the opportunity to follow her passion in the Arts & to travel. Living in California with her husband Rick for 15 years together they built a successful business. After the birth of her beautiful daughter Brittany, seeking a "small town” coastal lifestyle, they took a trip to Naples Florida & fell in love with all it has to offer and made the jump!

With now over 17 years experience as a licensed Realtor serving Naples, Bonita Springs, Marco Island, Estero & Fort Myers.

A great listener, negotiator & connector, Kimberly is dedicated to helping her clients looking to BUY their ideal Florida property!

Her warm & friendly personality is present in everything she does on her clients behalf!

Kimberly’s creativity & "out of the box" thinking gives her clients the extra leverage they need when SELLING a property.

Her well organized marketing includes professionally produced photography, video, drone imagery, media presentation in print, numerous online websites & social media!